40+ how much mortgage interest can i deduct

The co-owner is a spouse who is on the same return. If you took out your home loan before Dec.

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

Ad First Time Home Buyer.

. In addition to itemizing these conditions must be met for mortgage interest to be deductible. Web Basic income information including amounts of your income. Find The Right Mortgage For You By Shopping Multiple Lenders.

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Some interest can be claimed as a deduction or as a credit.

Web Topic No. However higher limitations 1 million 500000 if married. Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who.

Find The Right Mortgage For You By Shopping Multiple Lenders. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. You can claim a tax deduction for the interest on the first.

Homeowners who are married but filing. It Pays To Compare Offers. Web For 2021 tax returns the government has raised the standard deduction to.

Easily Compare Mortgage Rates and Find a Great Lender. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. It Pays To Compare Offers.

Easily Compare Mortgage Rates and Find a Great Lender. Interest is an amount you pay for the use of borrowed money. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

For married taxpayers filing a separate. Single or married filing separately 12550. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web A mortgage calculator can help you determine how much interest you paid each month last year. Web If youve closed on a mortgage on or after Jan. Web You cant deduct the principal the borrowed money youre paying back.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Discover Helpful Information And Resources On Taxes From AARP. Homeowners who bought houses before.

Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Ad First Time Home Buyer. Ad Start Using Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Web There are different situations that affect how you deduct mortgage interest when co-owning a home. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Married filing jointly or qualifying widow er. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. For more information see Publication 535.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction. Web If your home was purchased before Dec.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Mortgage Interest Deduction Bankrate

U S Senator Elizabeth Warren I M Thrilled That The 1 1 Million Members Of The National Association Of Realtors Have Endorsed My Bank On Students Student Loan Refinancing Bill They Recognize That Student

Sole Proprietorship Taxes Simplified

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Existing Properties Kfw

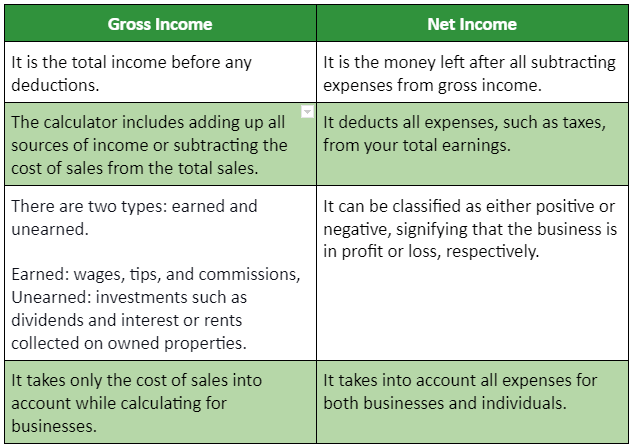

Gross Income Definition Formula Calculator Examples

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Every Landlord S Tax Deduction Guide Legal Book Nolo

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

Top 10 Home Office Tax Deductions

Interest Income How To Calculate Interest Income With Example

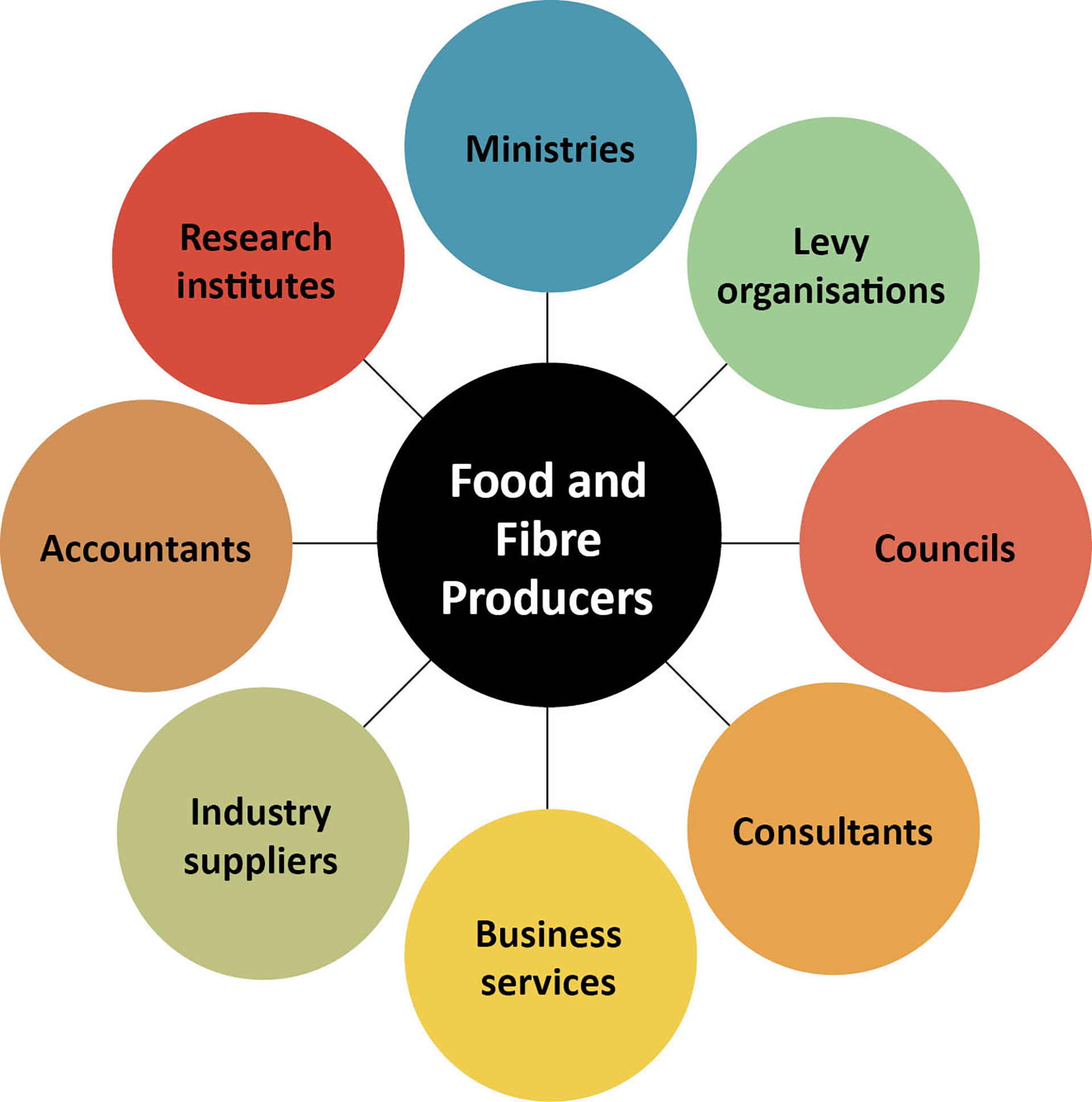

Frontiers Shifting Knowledge Practices For Sustainable Land Use Insights From Producers Of Aotearoa New Zealand

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Physical Capital Tangible Goods Purchased By The Household That Are Used Up Over Time Such Durable Goods May Serve As An Investment Or Means Of Storing Ppt Download

Mortgage Interest Deduction A Guide Rocket Mortgage

The Home Mortgage Interest Deduction Lendingtree

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023